FOOD & BEVERAGE – MERGERS & ACQUISITIONS QUARTER 2, 2018

Welcome to the Comet Line quarterly newsletter, where we review corporate activity in the food and beverage industry for the second quarter of 2018.

Corporate activity picked up in the quarter with twelve transactions announced, including two substantial transactions.

The transaction that stood out was the acquisition of a controlling interest in Australia’s third largest vitamins company, Nature’s Care, by a consortium of Chinese investors. The Nature’s Care transaction was the largest transaction announced in the quarter and is the largest transaction announced in the food and beverage industry in 2018 to date.

The NZ$438 million takeover of Tegel Group by Philippine-based Bounty Fresh Foods is also a substantial transaction. Bounty Fresh intends to use Tegel as a source of poultry for Asian markets by expanding Tegel’s distribution into international markets, including the Philippines.

The Nature’s Care and Tegel transactions confirm the strong investor interest for Australian and New Zealand food and beverage businesses from international investors.

The IPO market was subdued during the quarter with no new listings of food manufacturing or beverage companies on the ASX or the National Stock Exchange.

In this newsletter we also review economic data from the Australian Bureau of Statistics that was recently released. The economic data provides interesting insights into the state of the food and beverage manufacturing industry in Australia.

The economic data reveals a 1% decrease in sales income for the food and beverage manufacturing industry in 2016/2017. The decline in sales income follows three years of growth for the food manufacturing industry. The decline is mainly due to a 6% decrease in sales income from the meat category. The meat category accounted for 30% of industry sales income in 2016/2017 and the decrease in sales had a negative impact on the overall growth rate of the food and beverage industry. In addition, 5 of the 11 categories that make up the food and beverage manufacturing industry reported negative growth in sales income in 206/2017.

The outlook for corporate activity remains positive with several sale processes in the pipeline. Strong interest from domestic and international investors will continue to support deal activity in the food and beverage industry.

Acquisitions announced

| DATE | TARGET NAME | ACQUIRER | SECTOR |

| 26 Feb 18 | Impulse Marketing | The Distributors | Distribution |

| 1 Mar 18 | Austco Polar Cold Storage | Wingara AG | Cold storage |

| 5 Apr 18 | Hollier Dicksons | PFD Food Services | Foodservice distribution |

| 9 Apr 18 | Australia’s Oyster Coast | ROC Partners | Seafood |

| 11 Apr 18 | Q Catering & Snap Fresh | dnata | Prepared meals |

| 11 Apr 18 | Nature’s Care | JIC Investments & Tamar Alliance | Vitamins & supplements |

| 4 May 18 | Turi Foods (merger) | OSI International Foods | Meat processing |

| 11 May 18 | Shenzhen JiaLiLe Food (10%) | Freedom Foods | Dairy |

| 13 May 18 | Aussie Farmers Direct | Your Grocer | Grocery distribution |

| 21 May 18 | CBDG Joint Venture (45%) | Wattle Health | Dairy |

| 23 May 18 | Seafarms Group (15%) | Nippon Suisan Kaisha | Seafood |

| 29 May 18 | Tegel Group | Bounty Fresh Foods | Poultry |

| 8 Jun 18 | Matso’s Broome Brewery | Gage Roads Brewing Co | Craft beer |

| 20 Jun 18 | St David Dairy | Longtable Group | Dairy |

The standout transaction in the quarter was the acquisition of a controlling interest in Australia’s third largest vitamins company, Nature’s Care. Nature’s Care was acquired by a consortium that includes Beijing-based China Jianyin Investment (JIC) and Tamar Alliance, a joint venture between CITIC and Dah Chong Hong. The Wu family will retain a minority shareholding interest in Nature’s Care. Financial terms of the deal were not disclosed, but industry sources have estimated the deal size at around $800 million.

Another substantial transaction concluded in the quarter is the NZ$438 million takeover of Tegel Group by Philippine-based Bounty Fresh Foods. Bounty Fresh is a privately-owned company that operates a farm-to-market strategy resulting in it controlling and managing the entire supply and production chain. Bounty intends to use Tegel as a source of poultry supply for Asian markets, including the Philippines. Tegel started supplying product into the Philippines in 2016 and the Philippines is an important market for Tegel’s push into export markets.

PFD Foodservice announced the acquisition of Hollier Dicksons in April. Hollier Dicksons is a national wholesale distributor that specialises in confectionery, snack foods and beverages. The acquisition brings a new category into PFD’s product range and will bring PFD into the confectionery segment as a national participant.

Private equity firm, ROC Partners, announced a $20 million investment in NSW oyster business, Australia’s Oyster Coast. Australia’s Oyster Coast was formed in 2015 by combining a number of NSW south coast oyster growers. The investment resulted in ROC Partners taking a majority interest in Australia’s Oyster Coast. $10 million of the investment was made on behalf of the GO NSW Equity Fund with contributions from the NSW Government and First State Super.

Turi Foods, a leading Australian processor of chicken, announced a merger with US-owned OSI Group. OSI Group is a supplier of valued added food products across Australia and internationally and is a major supplier of beef to McDonald’s. The merger is effective from 4 May 2018.

Wattle Health raised $54 million through a share issue to fund its participation in the Corio Bay Dairy Group (CBDG) joint venture. The CBDG joint venture will build and operate an organic dried milk powder plant that can process up to 200,000 litres of fresh organic milk each day. The CBDG milk spray drying plant will be located at Geelong in Victoria.

ASX listed Seafarms announced a $25 million equity investment in the group by Nippon Suisan Kaisha for a 15% shareholding stake. The proceeds from the share placement will fund the development of project Sea Dragon, a large-scale land-based prawn aquaculture project in northern Australia.

ASX listed Gage Roads Brewing Co announced the acquisition of 100% of Matso’s Broome Brewery for $13.25 million plus deferred payments. Matso’s is an iconic WA beer brand best known for its ginger and mango beer varieties. The transaction was based on a run-rate EV/EBITDA of 5.3x.

Longtable Group has signed an agreement to purchase 100% of St David Dairy for $15.25m. St David Dairy was established in 2013 and is based in the Melbourne inner-city suburb of Fitzroy. St David is a premium foodservice dairy brand and services Melbourne’s leading cafés, restaurants and retailers with a range of milk, butter, cream and yogurt.

Performance of the Food & Beverage industry

Comet Line has reviewed the Australian Bureau of Statistics economic data for 2017 that was released in the second quarter of 2018. The economic data provides interesting insights into the state of the food manufacturing and non-alcoholic beverage industry.

Growth in Sales Income by Product Category

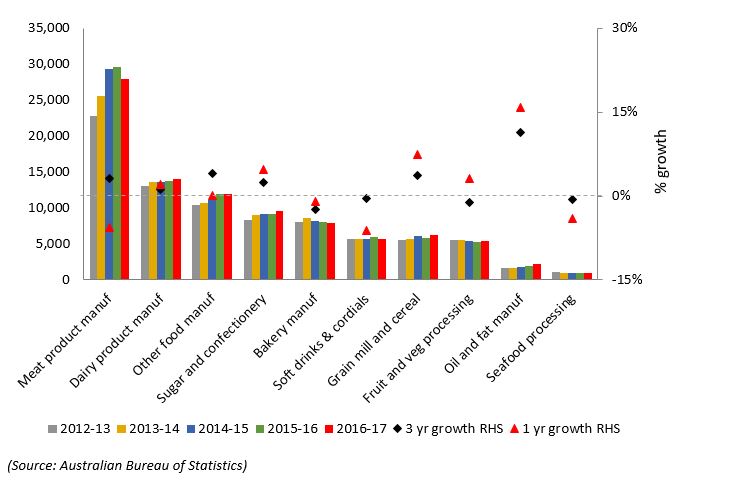

Following three years of sustained growth, the food manufacturing and non-alcoholic beverage industry recorded a 1% decline in sales income in the year to 30 June 2017. The decline is mainly due to a decline in the meat product manufacturing category which accounted for 30% of total sales income in 2016/2017. Sales income for the meat category declined by 6% in 2016/2017.

Excluding the meat category, sales income for the remaining categories grew by 2% in 2016/2017 (1% over a 3-year period). The oil and fat category (16% growth YoY and 11% over 3-years) and the grain mill and cereal category (7% growth YoY and 4% over 3 years) were the two fastest growing categories.

Sales income by product category (A$’million)

Annual growth in sales income by category

| Category | 3 years | 2 years | 1 year | % contrib |

| Overall industry | 2% | 0% | -1% | 100% |

| Meat products | 3% | -2% | -6% | 30% |

| Dairy products | 1% | 1% | 2% | 15% |

| Other food | 4% | 4% | 0% | 13% |

| Sugar and confectionery | 2% | 2% | 5% | 10% |

| Bakery | -2% | -1% | -1% | 9% |

| Soft drinks & cordials | 0% | -1% | -6% | 6% |

| Grain mill and cereal | 4% | 2% | 7% | 7% |

| Fruit and veg processing | -1% | 0% | 3% | 6% |

| Oil and fat | 11% | 12% | 16% | 2% |

| Seafood processing | -1% | 1% | -4% | 1% |

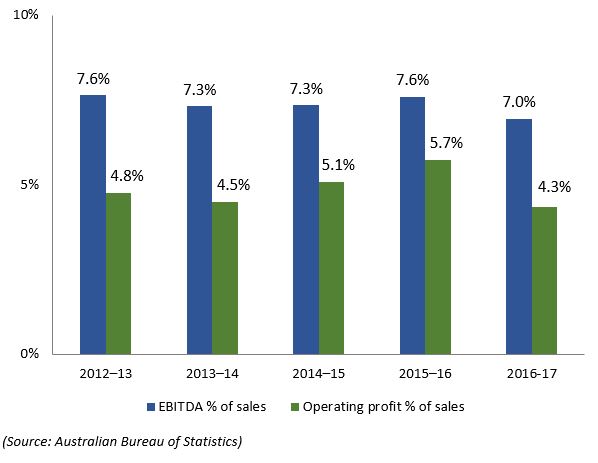

Profitability in the food and beverage manufacturing industry

Financial performance of businesses in the food and beverage industry declined with an 8% decrease in EBITDA and a 24% decrease in Operating profit before tax from the previous financial year. EBITDA as a percentage of sales income decreased from 7.5% (30 June 2016) to 7.0% in the year to 30 June 2017. Operating profit before tax as a percentage of sales income also decreased from 5.7% (2016) to 4.3% (2017).

Key profitability ratios

The cost of purchasing goods and materials remains the largest cost component for food manufacturers with this cost varying between 61% and 62% of sales income over the period. Labour costs are the second largest cost component and varied between 14% and 15% of sales income. Food manufacturers spent approximately 76% of sales income on purchases of goods and materials and labour costs. Labour costs and purchases of goods and materials combined, have increased by less than 1% over the past 3 years.

The decrease in EBITDA as a percentage of sales in 2016/2017 was due to an increase in other expenses (net of capital works). Other expenses (net of capital works) increased by 5% in 2016/2017 and accounted for the bulk of the 8% decrease in EBITDA in 2016/2017. Other expenses include cost items such as electricity and occupancy costs.

In addition, operating profit as percentage of sales was impacted by a significant decrease in Other Income (Other Income is not included in the calculation of EBITDA). The decline in Other Income resulted in a 13% decrease in operating profit before tax – overall operating profit before tax decreased by 24% in 2016/2017.

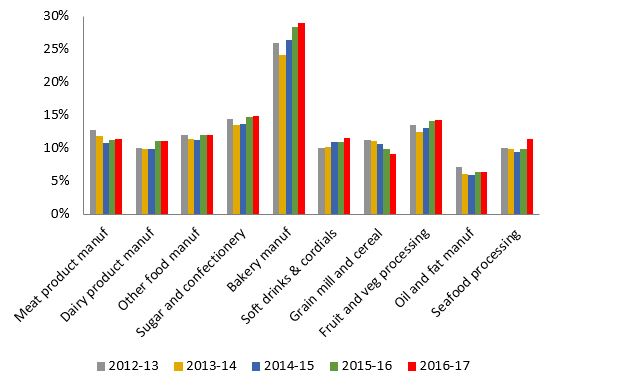

Labour costs

Labour costs are the second largest cost component for food manufacturers. Labour costs as a percentage of sales income varied across categories.

Labour costs as % of sales income

Overall industry labour costs increased by 1% in 2016/17 and the number of staff decreased by 1.5%. Average labour cost per employee increased by 2.4% for the food and beverage industry in 2016/2017.

Labour costs as a percentage of sales income is the highest for the bakery category with 29% of sales income applied to pay salaries and wages. The bakery category is highly fragmented and employs a large number of staff. In 2016/2017 the bakery industry employed 31% of all staff employed in the food and beverage industry but incurred only 19% of industry labour costs. The bakery category and the meat manufacturing category jointly employ 58% of all staff in the food manufacturing and beverage industry.

The bakery category has the lowest average labour cost per employee (~$34,000). We consider this indicative of the high level of manual operation and lower employee technical skills required in the bakery category.

The soft drinks and cordial category recorded the highest average labour cost per employee in 2017 (~$97,000). The soft drinks and cordial category also had the fourth highest annual increase in average labour cost per employee in 2017, an increase of 11% per year.

Likewise, the oil and fat manufacturing category has relatively high average labour cost per employee (~$85,000). Average labour costs per employee increased by 14% in the oil and fat manufacturing category in 2017.

No Comments