FOOD & BEVERAGE – MERGERS & ACQUISITIONS Quarter 2, 2017

Welcome to the Comet Line quarterly newsletter, where we review:

- Key M&A transactions for the 2nd quarter 2017

- Growth and profit data by product category

- Manufacturing labour cost benchmarking by product category

Corporate activity in the food and beverage industry for the second quarter of 2017 was relatively subdued with eight key transactions announced in the quarter.

The transaction that stood out was the acquisition of Mainland Poultry by Navis Capital for NZ$300 million. The acquisition by Navis Capital continues the trend by private equity investors to invest in this industry for its future growth prospects.

The IPO market was also subdued during the quarter with one listing on each of the ASX and the National Stock Exchange.

We also review ABS economic data released in the second quarter of 2017 which provides some interesting insights into the state of the food and beverage manufacturing industry in Australia. The economic data reveals annual growth rates for the industry of 6%, 5% and 1% over the past three financial years. We note that the larger categories such as meat product manufacturing and ‘other food’ manufacturing have growth strongly over the past three financial years (growth rates of 29% and 14% respectively). Fruit and vegetable processing and seafood processing have not done as well and sales income decreased by 7% and 12% over the past three financial years.

Acquisitions announced

| DATE | TARGET NAME | ACQUIRER | SECTOR | DEAL VALUE |

| 19 Apr 17 | Pie Face | United Petroleum | Baked Goods | Undisclosed |

| 26 Apr 17 | Mainland Poultry | Navis Capital | Poultry | NZ$300 million |

| 25 May 17 | Australian Dairy Park | Ausnutria | Dairy | Undisclosed |

| 29 May 17 | Alpine Soft Drinks & Equipment | Buderim Ginger | Beverages | Undisclosed |

| 30 May 17 | New Zealand Dairy Company | Synlait Milk | Dairy | NZ$33 million |

| 7 Jun 17 | RangeMe | Efficient Collaborative Retail Marketing | Marketing & Distribution | Undisclosed |

| 14 Jun 17 | Camperdown Powder (90%) | Bellamy’s Organics | Dairy | $28.5 million |

| 23 Jun 17 | Delicious and Nutritious (25%) | Oliver’s Real Food | Natural and Organic | $0.4 million |

The standout transaction in the quarter was the acquisition of Mainland Poultry by private equity firm Navis Capital for approximately NZ$300 million. The Mainland Poultry sale process attracted attention from several private equity investors. Looming capital expenditures over the next five years was reported to have impacted on the attractiveness of the Mainland Poultry business to several interested parties.

Hong Kong dairy company Ausnutria announced in May the acquisition of Victorian dairy manufacturer Australian Dairy Park (ADP). Upon completion of the transaction, Ausnutria will own the manufacturing, packaging and sale of dairy and milk powder products and related research and development activities.

Synlait Milk acquired New Zealand Dairy Company (NZDC) for NZ$33.2 million. NZDC is based in Auckland and is constructing a blending and canning operation capable of making infant formula and milk powders. Synlait expects to invest an additional $23 million to develop the facility.

RangeMe is an online platform that connects retailers with products and suppliers. RangeMe was founded in 2013 and soon afterwards expanded into the US. RangeMe was acquired by Efficient Collaborative Retail Marketing for an undisclosed sum in June 2017. Before its acquisition RangeMe had 10 people in Australia and 13 in San Francisco. The platform represented 65,000 suppliers with more than 250,000 items on the platform.

Bellamy’s Organics acquired the Camperdown Powder canning facility. Bellamy’s will pay $28.5 million for a 90% share in Camperdown Powder. Bellamy’s believes that the acquisition of Camperdown Powder will strengthen Bellamy’s strategic position and build brand credibility with trade partners and consumers. The acquisition will provide a path to CFDA registration of a Chinese label product for Bellamy’s.

LISTINGS ON THE ASX and NSX

| Date | Entity Name | Capital Raised | Issue Price | Sector |

| 21 Jun 17 | Oliver’s Real Foods Ltd (ASX) | $22.6 million | $0.20 | Organic and natural |

| 27 Jun 17 | Allwellness Holdings (NSX) | n/a | n/a | Health and wellness |

Oliver’s Real Foods is a fast food chain that serves certified organic product to customers. The company has 20 stores along major highways on Australia’s east coast, primarily in NSW and Victoria. The company plans to add another 40 stores over the next four years.

Allwellness Holdings listed on the National Stock Exchange on 27 June 2017. The company is an Australian based pharmaceutical manufacturing group that exports its products to China.

Performance of the Food & Beverage industry

Growth in Sales Income by Product Category

The food and beverage manufacturing industry performed strongly over the past four years. Sales income for the industry grew by 13% over the 3 financial years to 30 June 2016, with 2014 and 2015 the standout years with annual growth rates of 6% and 5% respectively. Sales growth in the 2016 financial year was 1% p.a.

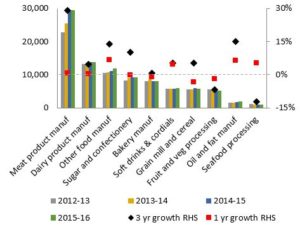

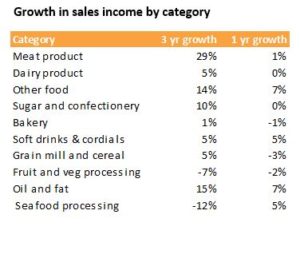

Growth in sales income was not evenly distributed with certain categories growing strongly, while other categories recording negative sales growth. In the graph below we compared the sales income of the different categories over the four financial years to 30 June 2016. We also plotted the 1-year and 3-year growth rates for each category.

Sales income by product category (A$’million) Growth in sales income by category

(Source: Australian Bureau of Statistics)

Three of the top four largest categories grew by 10% or more over the three-year period to 30 June 2016. Meat and meat product manufacturing, Other food manufacturing and Sugar and confectionery accounted for 55% of total sales income in the 2016 financial year. These three categories grew by more than 10% over the three-year period, with most of the growth coming in the first two years of the three-year period (2014 and 2015).

Growth in the meat industry over the three-year period was driven by strong growth in meat processing in 2014 and 2015 with materially lesser contributions from poultry and cured meats. The growth in the meat industry is supported by strong export growth in 2014 and 2015.

In 2016 none of the meat, dairy or sugar and confectionery categories grew by more than 1%. These three categories accounted for 57% of total sales income in 2016. Only the Other food manufacturing category showed notable growth of 7% in 2016. In 2016, the four largest categories accounted for 70% of sales income generated by the food and beverage industry.

The smaller categories did not perform well, with fruit and vegetable processing recording negative growth of 7% and 2% over 3-year and 1-year periods. Seafood processing also recorded negative growth of 12% over three years but bounced back with 5% growth in 2016.

Profitability in the food and beverage manufacturing industry

Financial performance of businesses in the food and beverage industry has been consistent at an EBITDA level over the past four years. EBITDA as a percentage of sales income varied between 7.3% to 7.6%. Operating profit before tax as a percentage of sales income increased from 4.7% (2013) to 5.7% (2016).

Key profitability ratios

(Source: Australian Bureau of Statistics)

The cost of purchasing goods and materials remain the largest cost component for food manufacturers with this cost varying between 59% and 61% of sales income over the four-year period. Labour costs are the second largest cost component and varied between 14% and 15% of sales income. Food manufacturers spent between 74% and 76% of sales income on goods and materials and labour costs.

The increase in operating profit as a percentage of sales income can be ascribed to two factors:

- increase in other income, e.g. increased income from sources other than sales of manufactured product; and

- decline in depreciation charges.

Other income earned by food and beverage manufacturers increased from 0.4% (2013) to 0.8% (2016) of total income with food manufacturers developing income streams to supplement income from manufacturing operations.

The depreciation charge decreased from 2.5% (2013) to 2% (2016) of total income. There is a level of concern about this decline in the depreciation charge as it could point to a reduction in capital investment which may negatively impact the future efficiency and capacity of the industry.

Labour costs

Labour costs are the second largest cost component for food manufacturers. Labour costs as a percentage of sales income varied across different categories as did the average cost per employee.

Labour costs as a percentage of sales income is the highest for the bakery industry with 28% of sales income applied to pay salaries and wages. The bakery category is highly fragmented and employs a significant number of staff. In 2016 the bakery industry employed 31% of staff employed in the food manufacturing industry. The bakery category also has the lowest average annual labour cost per employee. We consider this indicative of the high level of manual operation and lower employee technical skills required in the bakery category.

The soft drinks and cordial category recorded the highest labour average cost per employee. Labour costs as a percentage of sales income was 10.9% in 2016 for the soft drinks and cordial category, indicating lower levels of employment and higher levels of automation compared to the other categories.

Likewise, the oil and fat manufacturing category had relatively high average labour cost per employee. Labour costs as a percentage of sales income was 6.4% for the oil and fat manufacturing category in 2016, which is the lowest level across all the categories in the food and beverage manufacturing industry.

About Comet Line

Comet Line Consulting is a strategic advisory business that specialises in acquisitions and divestments within the Australian and New Zealand food & beverage industry. Deep industry knowledge and strong relationships with business owners, trade investors and financial investors are defining features of the Comet Line Consulting business.

David Baveystock has worked in the Australian food and beverage industry for over 20 years including senior roles with Nestle Australia and Manassen Foods. David is recognized as a leading executive in the food and beverage industry and consults to senior management and business executives.

Ben van der Westhuizen has 25 years corporate advisory experience and has advised on a variety of transactions including acquisitions, disposals and capital raisings. Ben has held senior corporate advisory roles with KPMG Corporate Finance, Challenger and PSG Group where he advised on several high-profile transactions.

Lindsay Cunningham has worked in the Australian and international food industry for over 35 years, with executive roles at Givaudan, Arnott’s, Uni Chef and I&J Foods. After a corporate career, Lindsay has directly provided strategic consulting services to a range of clients including Allied Mills, Arnott’s, Nestle, Fonterra, Goodman Fielder International, Lindt and the Sydney Fish Market.

CONTACT DETAILS:

David Baveystock | +61 400 217 471 | david@cometlineconsulting.com.au

Ben van der Westhuizen | +61 405 512 119 | ben@cometlineconsulting.com.au

Important Disclaimer – This may affect your legal rights: Because this document has been prepared without consideration of any specific person’s financial situation, particular needs and investment objectives, a financial services licensee or investment adviser should be consulted before any investment decision is made. While this document is based on information from sources which are considered reliable, Comet Line Consulting Pty Limited, its directors, employees and consultants do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or accurate. Nor does Comet Line Consulting Pty Limited accept any responsibility to inform you of any matter that subsequently comes to notice, which may affect any of the information contained in this document. This document is a private communication to clients and is not intended for public circulation or for the use of any third party, without the prior approval of Comet Line Consulting. This report does not constitute advice to any person.

No Comments