FOOD & BEVERAGE INDUSTRY – MERGERS & ACQUISITIONS QUARTER 2, 2019

Welcome to the Comet Line quarterly newsletter, where we review corporate activity in the second quarter of 2019.

Corporate activity picked up in the quarter with seventeen transactions announced. The transaction that stood out was the acquisition of the Tip Top ice cream business by Froneri. Froneri, the owner of Peter’s ice cream, paid Fonterra $380 million for the Tip Top business.

During the quarter Comet Line Consulting advised on the acquisition of Ingredient Resources by Connell Brothers. Ingredient Resources is a supplier of value-added functional ingredients to food manufacturers in Australia and New Zealand. The ingredient market is going through a consolidation phase and further transaction are expected in this sector.

We also review economic data on the food and beverage industry that was recently released by the Australian Bureau of Statistics.

The economic data reveals a pleasing 4% increase in sales income for the food and beverage manufacturing industry in 2017-18 up from a 1% decrease in sales income in 2016-17. The increase in sales income was driven by YoY increases of 4% and 7% in the meat manufacturing and dairy categories.

Of concern is the continued decline in profitability in the industry. EBITDA as a percentage of sales income declined from 7.6% in 2015-16 to 6.7% in 2017-18, highlighting the profitability squeeze being experienced by the food and beverage industry.

The outlook for corporate activity remains positive with several sale processes in the pipeline. The fundamentals that drove industry sales growth in recent years will continue to attract investors to the food and beverage industry.

Transactions announced

| Date | Target Name | Acquirer | Sector |

| 1 April 19 | Australia Deloraine Dairy | Bubs Australia | Dairy |

| 3 April 19 | Healthy Life (rebrand) | Go Vita | Health food retail |

| 9 April 19 | Meatsnacks Group | New World Foods | Meat based snacking |

| 26 April 19 | Lion Cheese business | Saputo | Dairy |

| 13 May 19 | Betta Milk | TasFoods | Dairy |

| 13 May 19 | Tip Top ice cream | Froneri | Ice cream |

| 14 May 19 | Ozone Organics | Aaron’s Organics | Distribution |

| 15 May 19 | Ingredient Resources | Connell Brothers | Ingredients |

| 15 May 19 | Nexba (series A capital raise) | Several investors | Beverages |

| 15 May 19 | Chefgood (capital raise) | Family office investor | Meal delivery |

| 15 May 19 | Australian Rainforest Honey | Webster | Healthy & natural |

| 31 May 19 | Marlin Fine Foods | Satisfine Foods | Foodservice wholesale |

| 4 June 19 | SPC Ardmona | Shepparton Partners | Processed fruit and vegetables |

| 8 June 19 | Marley Spoon (9.1%) | Woolworths | Meal kits |

| 13 June 19 | 180 Nutrition | Bega Cheese | Healthy and natural |

| 17 June 19 | Omniblend | Keytone Dairy | Value added dairy |

| 21 June 19 | FeedRite | SunRice | Animal feeds |

The standout transaction in the quarter was the acquisition of Tip Top ice cream by Froneri, the owner of Peter’s ice cream. Froneri bought the Tip Top business for $380 million from Fonterra. The Tip Top acquisition strengthens Froneri’s market share in the ice cream retail channel across Australia and New Zealand. Froneri is the third largest ice cream manufacturer in the world, selling ice cream in 20 countries. Froneri will retain the Tip Top brand name and the Tip Top operations including the Auckland factory site.

Another standout transaction was the sale of Ingredient Resources to Connell Brothers, a subsidiary of US-based Wilbur Ellis Group. Ingredient Resources is a supplier of value-added functional ingredients to food manufacturers in Australia and New Zealand. Comet Line Consulting advised Ingredient Resources on the sale of the business to Connell Bros.

ASX listed Bubs Australia announced the acquisition of Australia Deloraine Dairy for a consideration of $35 million, settled $25 million in cash and $10 million in shares. Deloraine is an infant formula producer and is one of 15 licenced canning facilities in Australia that meet regulatory import conditions into China. As part of the transaction C2 Capital Partners (15%) and Chemist Warehouse (9%) became shareholders of Bubs Australia.

Health food retailer Healthy Life has joined GoVita as members of the GoVita retail network. Healthy Life’s 50-plus store network will be co-branded GoVita & Healthy Life and will operate with GoVita’s 135 health store network.

Lion Dairy & Drinks announced the sale of the specialty cheese business to Saputo for $280 million. The sale included several speciality cheese brands such as King Island Dairy and South Cape, cheese manufacturing assets and two Lion-owned farms on King Island. The cheese business employs approximately 400 people.

New World Foods, a meat jerky company that was acquired by Tony Quinn in 2018, has acquired Meatsnacks Group. Meatsnacks is a leading UK based jerky and biltong manufacturer and brand owner. Meatsnacks Group will be merged with New World Foods’ UK business which is of similar size and scale.

ASX-listed TasFoods acquired Betta Milk’s milk processing assets and brands for $11.5 million. Betta Food is expected to report normalised EBITDA of $0.8 million for FY19, pricing the acquisition at 14.6x FY19 EBITDA. The acquisition will strengthen TasFoods’ existing dairy business.

Sugar free beverage company Nexba, raised $6 million from investors through a capital raise.

ASX listed agriculture company Webster acquired Australian Rainforest Honey, a bee apiary business located in NSW, for $5.2 million.

Coca-Cola Amatil sold fruit and vegetable processor SPC Ardmona for $40 million to Shepparton Partners Collective. Shepparton Partners, a joint venture between Perma Funds Management and The Eights, has offered ongoing employment to all permanent employees of SPC. The agreement includes an earnout which could deliver up to $15 million for Coca-Cola Amatil subject to business performance. Coca-Cola Amatil acquired the SPC business in 2005 and invested around $250 million in the SPC business.

Woolworths acquired a 9.1% stake in ASX listed meal kit group Marley Spoon.

Bega Cheese acquired 180 Nutrition, an online retailer of health and protein supplements.

ASX listed Keytone Dairy acquired Omniblend for a consideration of $22.6 million settled through the issue of Keytone shares and a cash consideration. Omniblend is a leading Australian product developer and contract manufacturer of health and wellness powdered and UHT drinks products. The acquisition of Omniblend was priced at 10.1x FY19 EBITDA plus an earnout component subject to Omniblend reaching set financial targets over a three-year period.

ASX listed SunRice acquired the extrusion assets of FeedRite, a leading manufacturer of extruded rice bran based equine feed. The cost of the acquisition and the capital expenditure to upgrade and expand the Coleambally Mill is expected to be less than $10 million.

Listings on the ASX

| Date | Entity Name | Capital raised | Issue price |

| 29 March 19 | Ecofibre | $20 million | $1.00 |

| 8 April 19 | Ricegrowers (SunRice) | Nil | n/a |

Ecofibre, an industrial hemp company listed on the ASX on 29 March 2019, raising $20 million in the process.

SunRice listed on the ASX on 8 April 2019 after transitioning from the smaller National Stock Exchange.

Both the Ecofibre and SunRice listings were well received by the market with both stocks reporting strong gains on listing date.

Economic Performance of the Food & Beverage industry

Comet Line has reviewed the Australian Bureau of Statistics economic data for 2018 that was released in the second quarter of 2019.

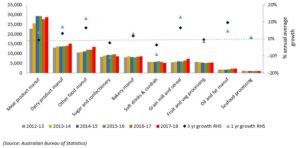

Growth in Sales Income by Product Category

Following three years of flat growth, the food manufacturing and non-alcoholic beverage industry recorded a 3% increase in sales income in the year to 30 June 2018. The increase is mainly due to increases in the meat and dairy manufacturing categories which accounted for 46% of total sales income in 2017-18. Sales income for the meat category increased by 4% in 2017-18 and dairy sales income increased by 7% over the same period.

Excluding the meat category, sales income for the remaining categories grew by 3% in 2017-18 (2% over a 3-year period). The grain mill and cereal category (13% growth YoY and 7% over 3 years) and the other food category (12% growth YoY and 7% over 3years) and were the two fastest growing categories.

Sales income by product category (A$’million)

Annual average growth in sales income by category

| Category | 3 years | 2 years | 1 year |

| Meat product | -1% | -1% | 4% |

| Dairy product | 3% | 5% | 7% |

| Other food | 7% | 6% | 12% |

| Sugar and confectionery | -2% | -3% | -11% |

| Bakery | 2% | 3% | 3% |

| Soft drinks & cordials | -4% | -7% | -9% |

| Grain mill and cereal | 7% | 12% | 13% |

| Fruit and veg processing | 0% | 1% | -1% |

| Oil and fat | 10% | 11% | 5% |

| Seafood processing | 1% | -2% | 1% |

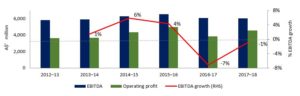

Profitability in the food and beverage manufacturing industry

Financial performance of businesses in the food and beverage industry continued to decline in the 2018 financial year with a 1% decrease in EBITDA, compared to a 7% decrease in the 2017 financial year. Operating profit before tax grew by 19% in 2018, compared to a decrease of 23% in the 2017 year.

Financial performance

Key profitability ratios

EBITDA as a percentage of sales income decreased from 7% (2016-17) to 6.7% (2017-18) over the past 2 financial years. Operating profit before tax as a percentage of sales income increased from 4.4% (2016-17) to 5.1% (2017-18).

The cost of purchasing goods and materials remains the largest cost component for food manufacturers with this cost varying between 60% and 62% of sales income over the period. Labour costs are the second largest cost component and varied between 14% and 15% of sales income. Labour costs and purchases of goods and materials combined, increased by 4% over the past year, which is slightly more than the increase in sales income over the year.

Other expenses (net of capital works) increased by 8.3% in 2017-18 and contributed to the 1% decrease in EBITDA in 2017-18. Other expenses include cost items such as electricity and occupancy costs.

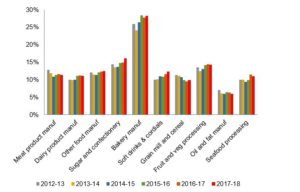

Labour costs

Labour costs are the second largest cost component for food manufacturers. Labour costs as percentage of sales income vary across categories.

Labour costs as % of sales income

Overall industry labour costs increased by 4% in 2017-18. The number of staff employed in the food and beverage industry increased by 1% and average labour cost per employee increased by 2.5% in 2017-18.

Labour costs as a percentage of sales income is the highest for the bakery category with 28% of sales income applied to pay salaries and wages. The bakery category is highly fragmented and employs the highest number of staff. In 2017-18 the bakery industry employed 31% of all staff employed in the food and beverage industry but incurred only 19% of industry labour costs. The bakery category and the meat manufacturing category jointly employ 57% of all staff in the food and beverage industry and account for 45% of the industry labour costs.

The bakery category has the lowest average labour cost per employee (~$35,000). The soft drinks and cordial category recorded the highest average labour cost per employee in 2018 (~$92,000).

No Comments